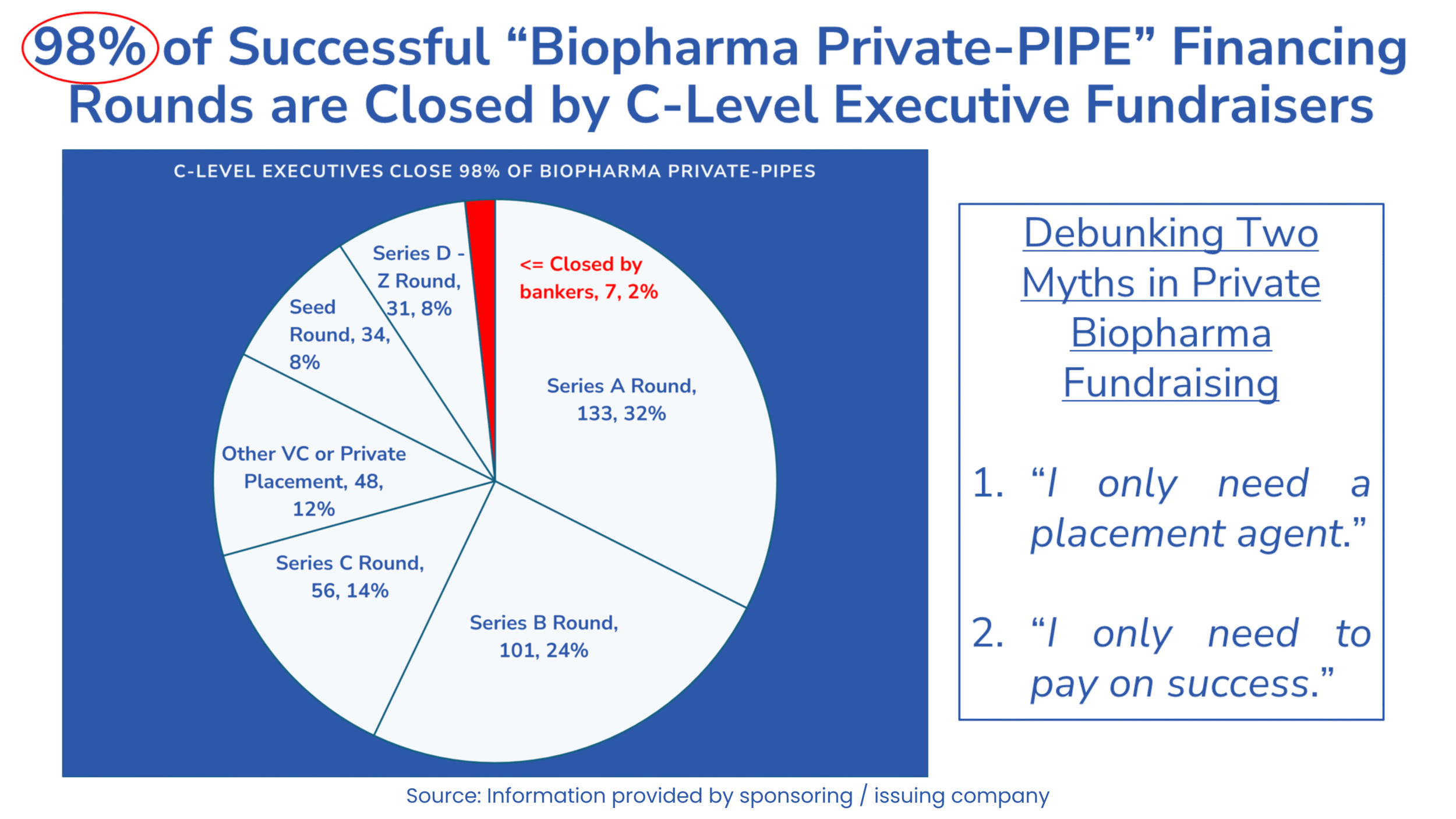

We Pioneered a Compliant Solution that Enables the Most Successful C-Level Executive Fundraisers to Help Private Biotechs Who Are Raising Capital Through Private-PIPEs

- Biopharmaceutical

- Medical Device

- Diagnostic

- AI-driven Healthtech

- Drug Delivery

Collabrity Executive Advisors (CEAs) have Proven Biotech Private-PIPE Fundraising Track Records

- Currently available CEAs are Board members with CEO/CFO backgrounds and have closed over $1 billion in Biotech Private-PIPEs

- Continuity Prized by Investors – CEAs continue post-financing in an operating or advisory role of your choosing

- Global Reach – the impact of CEAs is amplified by Collabrity’s Founder, Associates, and proprietary investor qualification technology, resulting in 5x more hours/month of support for your financing campaign vs. placement agents, more comprehensive outreach to qualified investors around the world, and a search that is not restricted to only one individual’s or one firm’s network

AnNie Qi® – Human-in-the-loop Precision Financing for the Precision Medicine Era

Try it out at AnNie Qi®

- 500+ profiled Private-PIPE Biotech investor database and created using our proprietary Artificial Intelligence / Natural Intelligence technology for Qualifying Investment or AnNie Qi®, this site demonstrates the powerful tools Collabrity brings to supporting private biotechnology company CEOs and investors.

The Collabrity Report Curates and Updates AnNie Qi® – Our Private-PIPE Investor Database

- Collabrity Report is now the most comprehensive free online resource for current biopharma financings worldwide

- “The Collabrity Report is a strong compendium of financing events, great for the field.”

David Schaffer

Director, QB3

Hubbard Howe Distinguished Professor, UC Berkeley

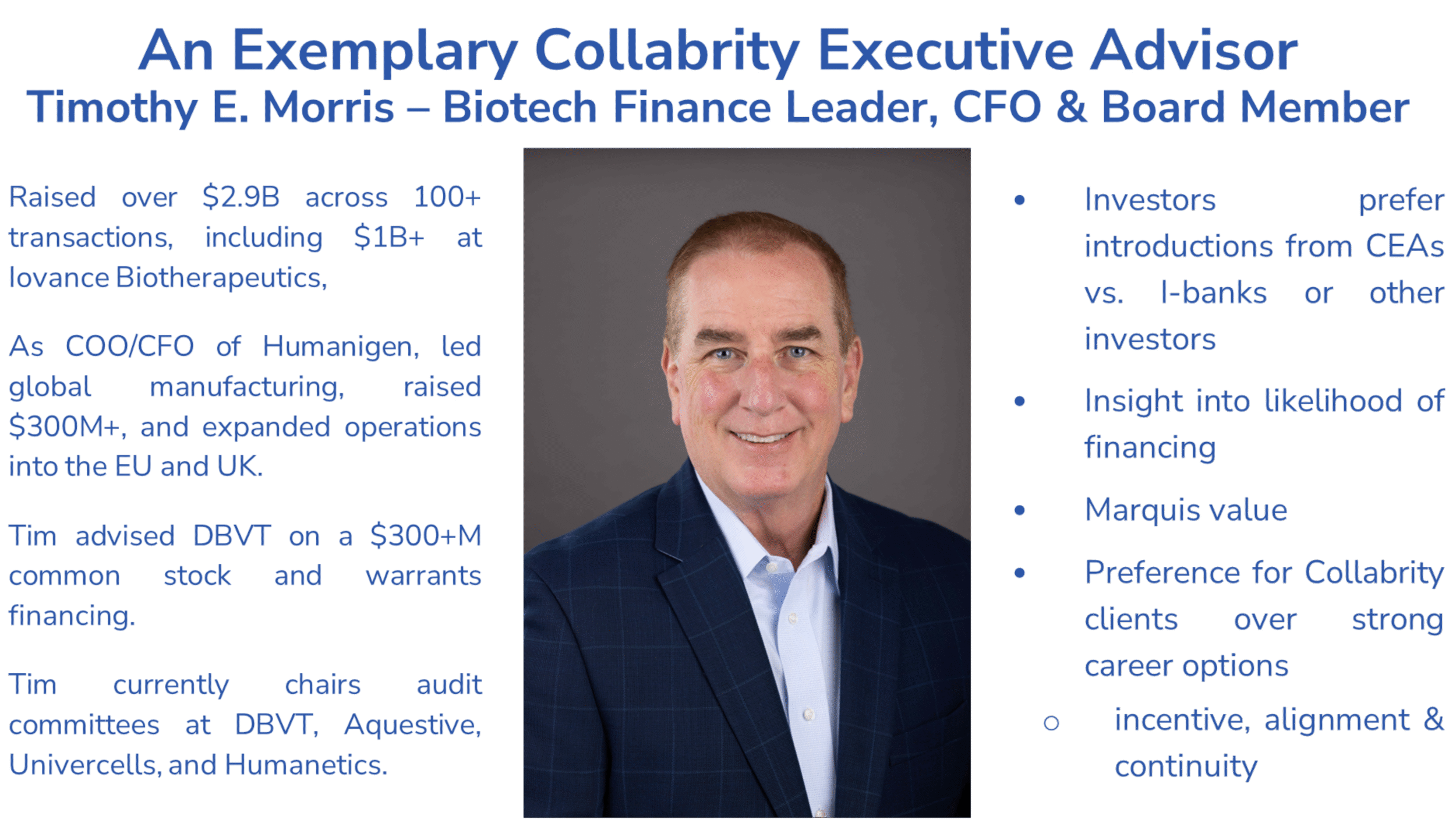

Source: Timothy E. Morris | LinkedIn

Highly-Qualified Executive Advisor Support

- Seasoned Leadership & Expertise – a career in biotechnology spanning business development and financial leadership roles encompassing all aspects of CBO / CFO’s responsibilities

- 28 partnering and financing transactions totaling over $950 million in announced value

© , all rights reserved

Contact Christopher Lehman, Founder

Securities are offered through Finalis Securities LLC Member FINRA / SIPC. Collabrity is not a registered broker-dealer, and Finalis Securities LLC and Collabrity are separate, unaffiliated entities. Finalis Securities LLC, Office of Supervisory Jurisdiction is located at 450 Lexington Ave, New York, NY 10017, 800-962-0418.

Finalis Privacy Policy | Finalis Business Continuity Plan | FINRA BrokerCheck | Finalis Form Customer Relationship Summary (“Form CRS”)

collabrity.com (the “Collabrity Website”) is a website operated by Collabrity. This website is for informational purposes only, is not an offer, solicitation, recommendation, or commitment for any transaction or to buy or sell any security or other financial product, and is not intended as investment advice or as a confirmation of any transaction. Products and services on this website may not be available for residents of certain jurisdictions. Please consult with a Finalis Securities’ registered representative regarding the product or service in question for further information. Investments involve risk and are not guaranteed to appreciate. Any market price, indicative value, estimate, view, opinion, data, or other information herein is not warranted as to completeness or accuracy, is subject to change without notice, and Collabrity along with Finalis Securities LLC accepts no liability for its use or to update it or keep it current.

Investing in private placements involves a high degree of risk. These investments may be illiquid, speculative, and subject to substantial restrictions on transferability. Investors may lose all or part of their investment and should only invest capital they can afford to lose. Prospective investors should conduct their own due diligence and consult with their legal, tax, and financial advisors prior to making any investment decision. For your reference, Finalis’ Form CRS describes the services that we provide, how we are compensated, and other important information about Finalis Securities LLC.